Introduction

The rapid growth across the GCC region has been well publicized, as has the growth and demand in the IT hardware sector across this region. The news of development itself is enough to drive the market frenzy.

The infrastructure development programs are back on track with billions of dollars being pumped for making smart cities, growing industries such as financial services, telecom, real state, hospitality and process industries, these industries strive to improve their capabilities and introduce innovative solutions to a growing market which has become more technology dependent. The vendor has to ensure that the technology is easy to use reliable and efficient in nature.

The IT hardware sector in the GCC region is emerging as on of the most dynamic, thriving IT environments on the globe and the demand for the IT hardware products market is estimated to be at USD 40 billion, with UAE, Qatar, Saudi Arabia leading the pack with hardware making up the largest share with 52% followed by IT services with 30% and software’s accounting for 18%.

With market barriers going down and foreign investments going up, the customers have become more demanding and more products focused. The recent trend seen is the migration of consumer from portable PC’s towards tablets/phablets. Add on devices like smart watch clubbed with the cost effective data packs from Network carrier is increasing the Smartphones product value.

PC/Laptop

The PC/Laptop market is forecasted to grow at 2-4% for next 3-5 years. The launch of Windows 10, Apple announcing the advent of new designed MacBook Pro to steer the markets in the current financial year. It is expected that 2.2 Million units be shipped to the GCC region for the year ended 2014.

The PC markets key shareholder is HP with 27% of the total market shares followed by Lenovo at 23%, Dell captures the third position with 18% market share. New entrants like ASUS and Acer controlling 12% & 7% market share respectively.

The slight slowdown in the sales was seen because of weak consumer spending followed by the inventory liquidation efforts in Oman, while Kuwait and Bahrain suffered due to ongoing social and political unrest. With the many expansion projects taking place in Saudi Arabia and UAE government’s decision for e-governance is expected to bolster the PC market in the region.

Mobility

The mobility market gained from the PC markets declining shares. Easy to carry, better battery backup and portability where some of the reasons for the tablet to catch up in the market. The mobility market grew by 10%+ with Samsung and Apple leading the market with 45% and 12% respectively. Catching up with Apple where Lenovo and Huawei, which held 10% each.

It is estimated that by the year 2018 the shipment of smartphone’s to the GCC region would increase to 125 million from the present 90 million. Better network, increase in Internet penetration coupled with cost effective data plans from the network carriers has led to increase in sales of smartphones and tablets.

The mobility market saw a total of 12 million units being shipped to the GCC regions with another 6 million being re-exported to other neighboring countries & Africa. PC and mobility with competitive edge, hold the bulk of the IT market share. Qatar, Saudi Arabia and UAE lead the pack among the GCC nations.

Accessories

Accessories form an integral part of the product offering but the cost of handling is on the higher side. The market for the accessories is suffering because of the parallel grey market running and pilferage rate is high in this category. The net gross profit percentage is bit on the higher side when compared wit the PC and the mobility to 15% and above.

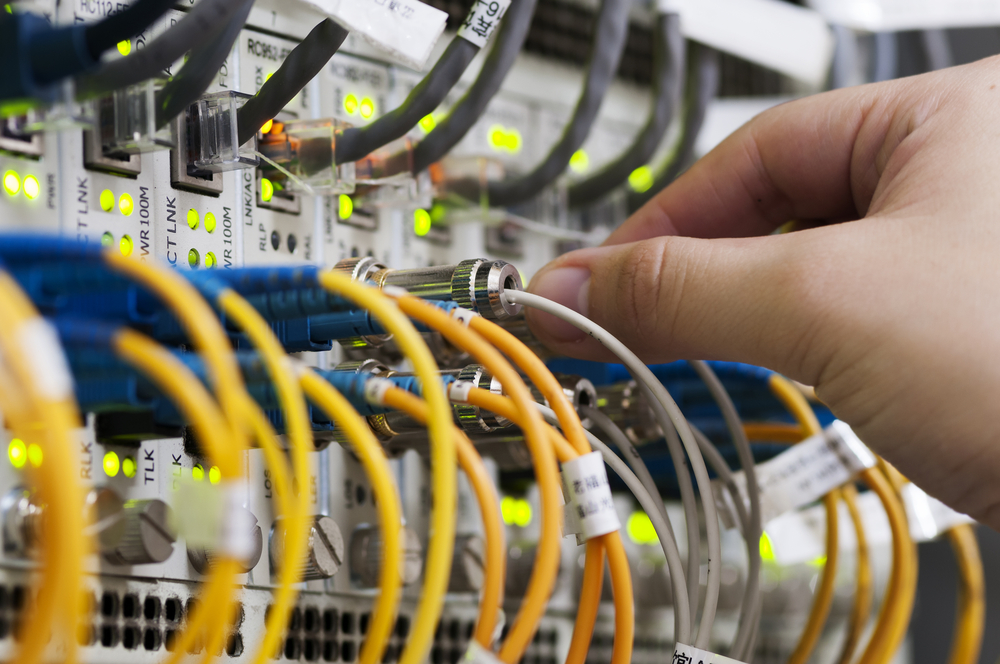

Networking & Storage

The market for networking and storage has risen sharply in the recent times because of the above factors. Corporates are now moving towards cost effective cloud based environment, with so much of data to be handled, it require e-security to protect the sensitive data of the organizations.

The external storage market devices are growing with more and more consumers opting for external drive rather than going for internal drives. The storage market saw the shipment to the GCC region grew to 2 million units. By the end of 2015 the storage market would stand at USD 315 million. Western Digital and Seagate having a market share of 35% each, followed by Toshiba. The networking market is lead by Cisco with 60% of the market, followed D-link and TP-link.

Printer

The government organizations are the biggest users of the printer in the GCC region, which ensures that any official communication is dealt in hardcopy instead of communicating the e-way. With the introduction of Wi-Fi based printers the market for cable connected printers has gone down so has the market for inkjet printers which are being replaced by fast laser printers and multi function printers with Print, Scan, Fax, Copy function. The printer market HP is the clear leader with 70% of the market share followed by Canon with 18%, Epson, Ricoh and Xerox being others.

Components

With the PC market on decline and no more requirement for motherboard, memory module and graphic cards the component market is under decline. The increase in sales of mobility products where they are already installed with different architecture and are different when compared to the components used in the PC.

Conclusion

The rising need for IT services which includes IT hardware sector has been driven by factors like continuous economic growth, infrastructure development and Organizations looking to extract further value from there IT investments. The total size of the IT hardware market alone in the GCC was valued at $ 8.2 billion in 2013 and $ 8.8 billion in 2014. Organizations are leveraging IT services in order to differentiate how they go to market, improve internal operations and boost profitability. The concept of e-governance, e-payments, e-permits and data integration has revolutionized the information system.

Accessories market is another category which has high gross profit rate with little or small investment required .The problem faced by accessories is because of the parallel grey market, running and selling the same product for much lesser price.

With GCC nations investing in telecommunication, banking services, process industries, educational institutes and projects like FIFA 2022 in Qatar, Expo 2020 in Dubai are in line with the growth trends seen in the recent years in the GCC nations.

Higher per capita income has led to higher spending with Qatar accounting for the highest per capita income of USD145000 followed by Kuwait at USD 71000 and UAE USD 63000. This trend can be seen as positive sign for times to come.

Looking at the market trends and future prospects, for new entrants it would be advisable to carefully evaluate the decision of a Greenfield vs. Potential Acquisition.

*Entrant: it is defined as an individual/business house or a local conglomerate that wants to operate as a distributor in the GCC market