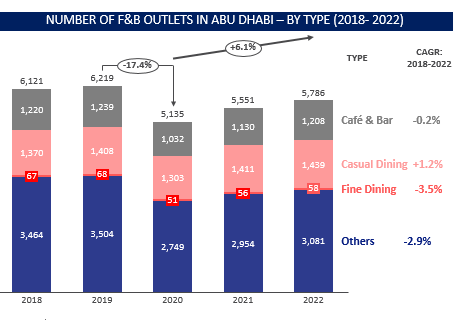

A casual dining restaurant offers a more relaxed atmosphere that offers time and space for relaxing while being affordable. In GCC, Abu Dhabi has one of the highest F&B outlet density, the emirate had one restaurant per 266 citizens in 2022. During 2018-2022, F&B outlets decreased at a CAGR of 1.4%, mostly as a result of the pandemic and related economic restrictions. The sector is in its recovery phase, and though still below the pre-pandemic level, recording a high growth rate of 6.1%

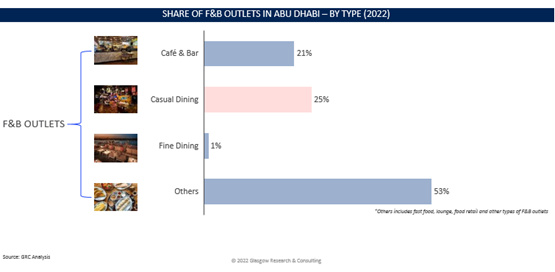

Share of F&B Outlets in Abu Dhabi

Among the F&B outlet segments, the casual dining concept is seen to be the largest segment, accounting for over 25% of all outlets in 2022, followed by café and bars, and others. Casual dining was the only segment which recorded positive growth during 2018-2022, outlining the changing consumer preferences in favor of these restaurants.

Source: GRC Analysis

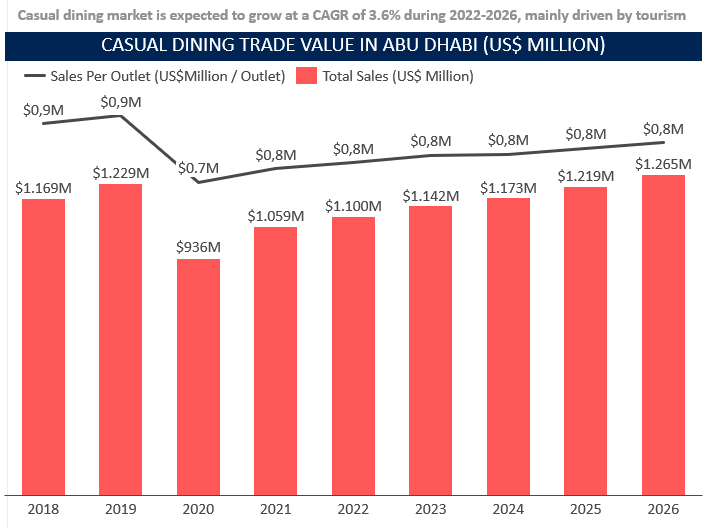

Casual Dining Growth & Trade Rate

Casual dining market in Abu Dhabi is projected to grow at a CAGR of 3.6% during 2022-2026, and will reach total trade value of US$1,265 million. The sector will take another 4 years to offset the impact of pandemic related disruption, as the emirate is expected to surpass pre-pandemic sales only by 2026.

Source: GRC Analysis

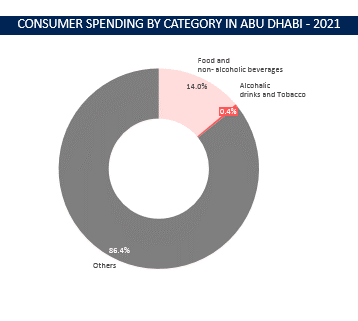

Consumer Spending Trend in Abu Dhabi

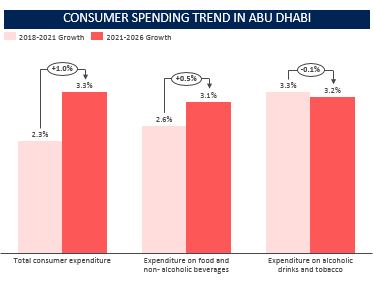

Abu Dhabi consumers spent ~14% of total spending in food and non-alcoholic drinks in 2021, while only 0.4% of their total spend goes towards alcoholic beverages and tobacco related spending. Historically, the spending in food and non-alcoholic beverages increased by 2.6%, higher than the overall expenditure; however, during forecast, the F&B spending will increase (~3.1%) but will remain less than of total spending (3.3%).

Source: GRC Analysis

Conclusion

The casual dining and social drinking market are mainly driven by the demand from resident population and Western expats living in the Emirate. Abu Dhabi population has increased at a rate of 2.0% during 2018-2022, which added to the demand for food and beverages sector in the Emirate. Urban population in Abu Dhabi is expected to increase from ~88% in 2021 to ~90% in 2030. This demographic shift will support the demand for food and beverages sector.