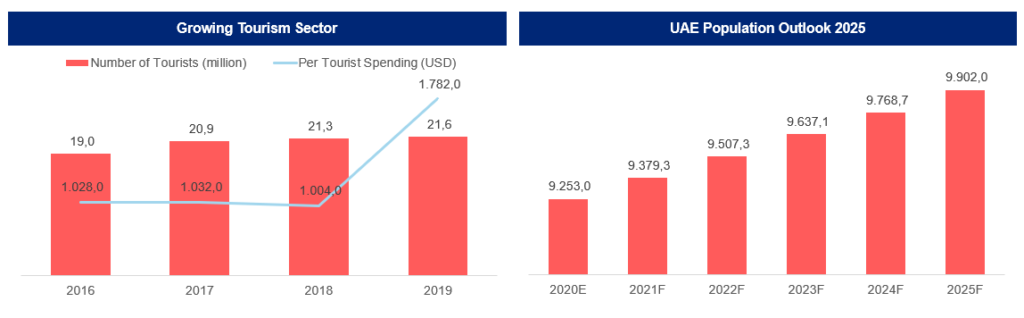

When we speak about the United Arab Emirates (UAE), we clearly know that it is one of the most visited countries in the world. Dubai being one of the Emirates has been listed as the sixth most visited city in the world. As such, the high number of tourists arriving in the country adds to the spending on food and beverages, supporting the domestic food services industry. Understanding the importance of tourism in the country’s economy, the UAE Cabinet in January 2021, approved the formation of Emirates Tourism Council with the objective of strengthening the tourism portfolio of the country.

UAE population outlook 2025

UAE population in 2020 was estimated to be 9,25 million and is projected to rise by 1.4% to reach 9.9 million by 2025. The increase in population will boost the domestic demand for meat product consumption in UAE.

Source: GRC Analysis

Animal products account for one fourth of total food consumption in UAE

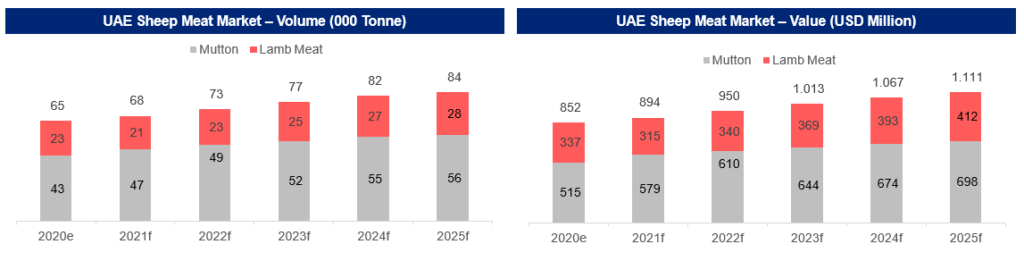

In 2020, average animal product consumption in UAE was estimated to be about 64 kg per capita per year while vegetable consumption was 89.3kg per capita per year and cereals consumption was 184 kg per capita per year. Poultry products were the most popular category of animal products, accounting for over 54% of the total meat consumption in the country, followed by lamb and other meat with 25% of the consumption. Lamb meat accounted for 35% of total sheep meat demand by volume, and 36% of demand by value due to their high price.

Sheep meat demand in UAE is met through imports as well as domestic farming of sheep

UAE sheep meat market has been estimated by determining the net import (import-export) of sheep meat in various forms such as live animal, fresh/chilled meat, and frozen meat. Sheep meat is imported in the country either in form of fresh/chilled meat, frozen meat or as live animals which then slaughtered to receive the meat. Domestic sheep meat supply starts in form of live animals, which then slaughtered, and converted to meat for local market or export.

Live sheep and lamb are either imported from other countries, or reared in domestic farms in UAE. These live animals are fed to increase their weight and sold in local meat market to be slaughtered for meat supply. Fresh/chilled meat are obtained from slaughter of live animals. These meat products are then sold at retail stores or to HORECA (Hotel, restaurant and catering companies). Fresh meat is stored in the deep freezer for long term use and sold in different product form in retail market or used by HORECA segment as well

Sheep meat demand is expected to increase at a CAGR of 5.2% during 2020-2025

During 2020-2025, the sheep meat market is expected to rise by 5.2% by volume, reaching 83,690 tons. Market by value is expected to grow relatively faster CAGR of 5.4%, mainly due to increase in prices. Lamb meat market is projected to grow at relatively less CAGR of 4.3% as compared to mutton demand growth of 5.6%, this is due to changing demand patterns towards less costly mutton.

Source: GRC Analysis

The market will reach the pre-pandemic level only by 2024, this is due to structural changes in demographics such as income levels, and outflux of migrants. The demand is also expected to be negatively impacted by growth in demand of meat substitutes. Demand for meat substitutes such as vegan meat, plant-based meat etc. are expected to increase at a CAGR of 6.1% during 2020-2025.

Conclusion

Sheep meat market in UAE is growing steadily over the past four years and expected to grow at a CAGR of 5.2% during the forecast period 2020-2025. Growing population, tourism and increase in per capita income are expected to drive the sheep meat demand. High demand-supply gap (in 2020 58% of the demand was met through imports), and low competitive intensity makes the market attractive.