Steel fabrication is the process of transforming crude steel (ingots, billets) or semi-finished steel (plates, sections, rebars, wires) into desired shape for application in various industries such as construction, machinery manufacturing, automotive, etc. The process produces metal structures using a range of processes such as cutting, bending and assembling. Below is an overall overview of the GCC market size of steel fabrication.

GCC steel fabrication market is mainly driven by the several construction and infrastructure projects, along with oil & gas sector developments in the region. The demand for fabricated steel products has witnessed decline since 2017, mainly on the part of completion of high number of construction projects planned in early 2020s. The overall decline in steel fabrication consumption is mainly due to decline in Saudi Arabia, UAE and Qatar market.

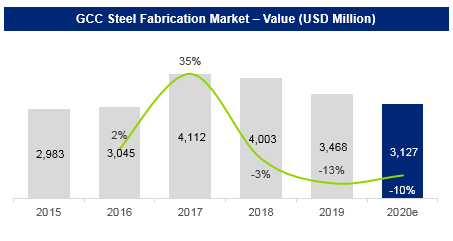

The GCC steel fabrication market was estimated to be approximately USD 3.0 billion in 2020, a decline of 11% over 2019. The decline was mainly due to COVID-related economic disruptions such as halts on construction projects, suspension of manufacturing activities, etcetera. Over 550 projects worth USD 60 billion were cancelled or suspended in GCC during March-December 2020 period. During 2015-2020, GCC steel fabrication market witnessed a CAGR of 3.8% by value and -3.5% by volume as illustrated in the slide below:

Source: GRC Analysis

Source: GRC Analysis

Demand drivers of steel sheet fabrication

According to the market size by raw material type, we found out that the demand for steel sheet fabrication is mainly driven by the construction sector, and oil & gas industry where platform fabrication requires significant use of steel sheets and plates. Saudi Arabia and UAE accounted for majority of the demand for steel sheet fabrication in the region, mainly driven by their investments in construction and energy infrastructures.

The light section fabrication accounted for second largest market by value and third largest by volume, mainly due to their usage in secondary steel work such as roof fabrication, purlins and side rail fabrication etc. Steel sheet fabrication was the largest segment in steel fabrication sector in GCC, accounted for 46% market by value and 50% market by volume in 2020 as shown in the diagram below:

Source: GRC Analysis

Users of steel fabrication products in the GCC

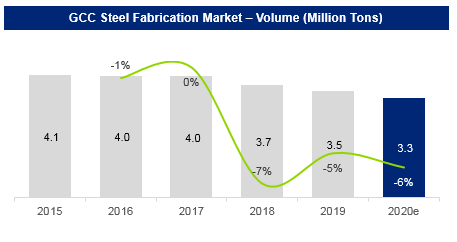

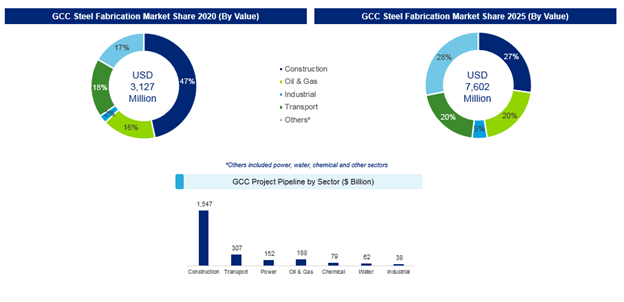

The construction sector is the largest consumer of steel fabrication products in the GCC region, this can be credited to vast number of projects in residential, non-residential and infrastructure segment currently being executed in the region. Projects in oil & gas, transport, and chemical sector are expected to capture more market share than construction sector. While the project spending across industries are expected to remain subdued during years 2021-2023, investments are expected to pick up in 2024 to meet the deadlines of projects planned for respective National Visions in GCC region such as Saudi Arabia National Vision 2030

In 2020 the construction sector accounted for 47% of total steel fabrication consumption, while the share is expected to drop to 27% by 2025 as illustrated in the charts below:

Source: GRC Analysis

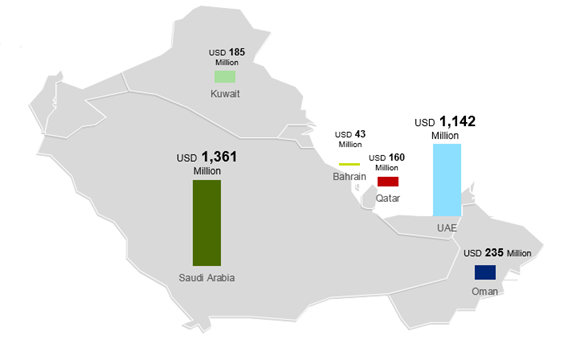

As a country, Saudi Arabia (44%) and UAE (36%) accounted for over 80% of the fabricated steel products consumption in 2020. Qatar was the third largest consumer of steel products till 2017, however, post 2017, the decline in construction projects resulted in Oman replacing Qatar for third largest steel consumer in the region. As seen on the map below:

Source: GRC Analysis

Conclusion

According to the analysis, the global market will grow by between 3% and 4% per year in the period up to 2025, to reach a value of $139 billion by 2025 on the back of a 151 million tons in production volume. Riding this wave, the Middle East’s industry is expected to co-benefit, with a share of local production exported to other parts of the world.

While project spending across industries is expected to remain subdued in 2022 and the early parts of 2023, investments are then expected to pick up meet the deadlines of projects planned for respective National Visions in the GCC region, with Saudi Arabia’s Vision 2030 the main driver of megadevelopments. In the Kingdom, Neom (the Kingdom’s flagship project), the Red Sea Project, and Qiddiya (the capital of entertainment) are some of the key mega projects shaping the infrastructure and construction roadmap.