It is no secret that UAE is home to all automobile enthusiasts. Seeing a convertible Rolls-Royce or a fiery Bugatti whiz past you in the street is a common sight. The Dubai police has exotic Bugatti, Ferrari, Bentley, Lamborghini, Camaro, and many more supercars at their disposal, something not seen anywhere around the world.

Being a significant player of automotive industry in the Middle East and North Africa region, there’s a lot to explore in the UAE passenger car market.

UAE Car Market Size

The Government of the United Arab Emirates supports the automotive sector as a key revenue generator. As a result, it is one of the fastest-growing automobile markets in the Middle East region. After Saudi Arabia, UAE holds the second-largest automotive market position in the Gulf Cooperation Council (GCC).

After the 2008 financial crisis, the UAE automotive market gradually began to recover. There was outstanding growth between late 2010 to early 2015. This growth was disrupted in the second half of 2015 as oil revenue declined. The situation turned for the better in 2019, but soon Covid pandemic hit the country affecting the sales of the automobile. While the sales of new cars dropped by almost 50%, the market for used and pre-owned cars saw a rise in sales. With the air of uncertainty in the economic sector, earnings dipped and consumers preferred to buy second-hand cars. Many auto manufacturing companies were forced to halt the production of new cars, resulting in a surge in used car sales in the market. The period after the pandemic saw a quick rise in the sales of new cars. In fact, the UAE vehicles market is unable to meet the sudden demand surge. There is a six to twelve months waiting period on most high-end cars.

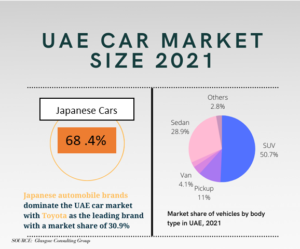

With this rise in the purchase of new vehicles, Japanese automobile brands continue to thrive in UAE. According to a report by Dubai Customs, Japan is the UAE’s top automobile trading partner. Toyota, one of the largest automobile manufacturers in the world has a market share of 30.9% in UAE. Japanese brands traditionally regarded as more dependable than their European and American counterparts–are the country’s best sellers. Brands like Toyota, a consistent market leader from 2015 to 2021, Nissan, and Mitsubishi dominate in the UAE market. Toyota models like Hilux, Land Cruiser 200, Prado, Corolla, Yaris, and Camry continue to drive the brand’s sales in UAE. Japanese brands have great resale value and with the increase in purchase of used vehicles, more people are choosing Japanese brands. Other reasons that constitute for the popularity of Japanese brands include the easy availability of spare parts at cheap rates, and low maintenance of these cars. With safety and appearance, consumers also look for quality and endurance, this is why the percentage of SUVs in the UAE is relatively high compared to other countries in the world.

With the UAE staging a strong recovery following Covid-induced global slowdown, Dubai’s value of export and re-export has surged 21.8% year-on-year, reaching Dh.147.3 billion in January-August 2021, according to the Dubai Chamber of Commerce and Industry.

UAE Luxury Car Market Size

The luxury car is a status symbol for the elites in UAE. Most people (and not just a certain percentage) enjoy a high standard of living in the UAE than in the rest of the world. Also, Dubai does not impose income tax on income of resident. It was a completely tax-free nation until 2018. Still, taxes are pretty low in UAE compared to other nations. As a result, the market for luxury goods is at an all-time high in UAE. Whether owing to the rise in the per capita income of consumers of UAE, the smooth road conditions, or the favorable tax regime; the luxury car market is witnessing growth in the country. At present, the luxury car market occupies almost 15% of the total Car market in UAE. Features like integrated entertainment systems, automatic safety features, and excellent finish of the interior and exterior of the car are pushing people to invest in luxury cars.

Pre-owned Luxury Car Market

The market expansion of luxury cars is not just on account of private owners but also rentals. The demand for renting luxury cars is common in UAE. There are several online marketplaces where you can rent the choice of your car by hours or for a day or two. Tourists who like to experience the luxurious side of UAE usually rent these supercars. Many people also rent on special occasions, while some rent out of their undeniable love for supercars. It is also popular for consumers to lease a vehicle for a flexible tenure. Given that one does not need to spend on regular maintenance or switch to a different model at any time, leasing vehicles is a popular choice.

During the pandemic, the used-car market in UAE got a boost and many people settled for second-hand luxury cars. As people were concerned with health and hygiene, people went for private ownership of cars instead of rentals. Given the financial constraint during the pandemic, they settled for second-hand luxury cars.

The market of luxury cars is reviving after the Covid pandemic hit the luxury car industry equally hard as the other economic sectors. Ferrari, always popular in Dubai for buying and renting faced a sales decline of more than 40%. Müller-Ötvös, Rolls-Royce CEO told Reuters, “Covid forced many people to ground, not to travel anymore and for that reason, there is quite a lot of wealth accumulated and that is spent on luxury goods.”

There’s also a growing interest among consumers in SUVs besides luxury sedans. The share of SUVs is growing at an accelerated rate as it occupies approximately 62% of the total luxury market. The top luxury car players include BMW, Daimler, and Toyota with the highest sales in UAE.

UAE Electric Vehicle Market

Globally, a gradual shift to electric vehicle is observed due to increasing concerns for climate change. Experts believe electric vehicles can revolutionize the transport industry since greenhouse gas emitted from vehicles is one of the largest contributors of greenhouse gas emissions. The UAE Electric Vehicle market is currently in its early stages. There has been some significant development between 2018 and 2021 as a result of the UAE government’s Electric Vehicle (EV) Green Charger initiative. However, due to Covid, the supply chain and the manufacturing process was disrupted.

The high demand for renewable and emission-less vehicles while maintaining luxury creates profitable growth opportunities for the UAE electric vehicle market. Besides, electric vehicles are less expensive to operate and are low on maintenance than other modes of transportation. In terms of revenue, the UAE Electric Vehicle Market is expected to grow at a CAGR of 24.2 percent between 2022 and 2028. Dubai has stated that by 2030, 10% of all vehicles will be electric or hybrid.

Supportive Government Policies

The Government has extended favorable support in expanding the electric vehicle market in the country. UAE has several charging stations and is working on increasing the number. To support the Dubai Green Mobility Strategy 2030, the Dubai Electricity and Water Authority launched the “Green Charger” initiative to build charging stations in Dubai. Dubai has exempted toll charges on electric vehicles and free charging stations at DEWA Green charger. The government and various financial institutions are providing incentives to encourage the import of electric vehicles into the country.

In terms of major vehicle brands, Hyundai Motor Company, Tesla, Inc., Volkswagen Motor Company LTM, General Motors Company, Groupe Renault, BMW AG, Ford Motor Company, Mitsubishi Fuso Truck, and Bus Corporation will be the key players in bringing about the electric vehicle revolution in the country.

Future of Car Market in UAE

Dubai will continue to act as the main automotive hub for major exports and re-exports of vehicles in the region. It is a leading exporter and re-exporter of automobiles to the Middle East and North Africa (MENA) region. Whether due to its strategic location or favorable government policies or advanced infrastructure, the automobile industry will continue to flourish.

The used-car market demand as created by the pandemic will increase. Earlier in the year 2020, the Used Car Market in UAE was worth USD 12.6 billion. And it is further expected to grow at the rate of USD 18.3 billion by 2027 growing at a CAGR of 5.7%. The online portals selling pre-owned cars will contribute to this growth.

UAE Government is emphasizing integrating the public fleet with electric vehicles. Dubai RTA is focusing on increasing its Hybrid Electric Vehicle fleet. The country has already invested heavily in promoting electric vehicles, and it aims to be the first in the region to be emission-free by 2050.

About Glasgow Research & Consulting

Founded in 2010, Glasgow Research & Consulting is a leading full-service business research and advisory services firm, with core expertise in market intelligence, market entry and trade development.

With offices and affiliates in Dubai, Riyadh, Harare and Auckland, we deliver customized research-led solutions across key industries in Middle East & Africa region and global emerging markets. We have successfully delivered over 750+ projects across industries helping customers develop actionable insights, establish feasibility and successfully enter new markets.

Our clients are Global Fortune 500 companies, regional conglomerates and entrepreneurial ventures.

The ability to anticipate competitors’ moves and analyse markets is key to winning in the Middle East & Africa region. Our biggest pride comes from helping international companies to be successful in emerging markets.