FM service market is an attractive market for investment with projected growth rate outpacing the economic growth of Egypt. Facility management market in Egypt was estimated to be about USD2.1 billion in 2021 and is expected to reach USD2.99 billion by 2025, representing a CAGR of 9.0%. vis-à-vis 5.58% GDP growth rate. Customer awareness on the importance of FM in improving property value and efficiency has resulted in increased outsourcing of FM services, which is expected to grow at a CAGR of 15.2%.

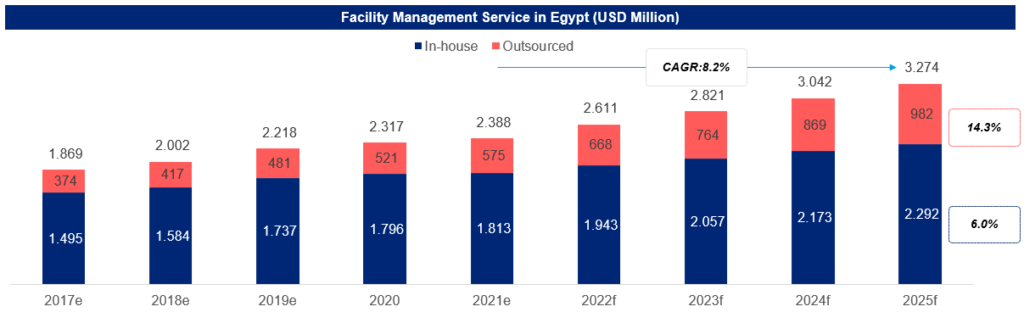

Facility management market in Egypt is characterized by the in-house supply of services

Although limited in terms of technology and equipment, majority of the FM services are performed in-house by the department and teams of real estate developers. In 2021, in-house FM services accounted for 75.9% of total market. The market is mainly driven by the supply of real estate in the country, mainly from commercial public / infrastructure, and tourism related real estate supply

In 2021, Facility management service market in Egypt was estimated to be about USD 2,388 million, contributing about 0.5% to the nominal GDP. The market is projected to grow at a CAGR of 8.2% during 2021-2025 as illustrated on the chart below:

Source: GRC analysis

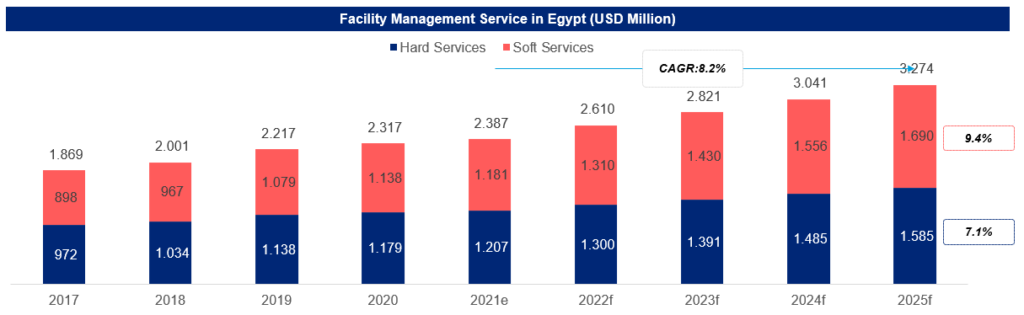

Soft facility management service is the fastest growing facility management service segment in Egypt

Demand for soft services were more in the Egypt FM market; however, due to high value, revenue from hard FM services had the equal share in the total market. HVAC maintenance and related services were the major hard services required in Egypt market, accounted for about 35% of total hard services revenue. Fire alarm and lighting maintenance were the second largest hard service segment, each accounted for 20% share of hard services.

Soft services are the fastest growing segment of facility management, growing from 50.3% of total market in 2021 to 52.3% in 2025. Cleaning and housekeeping, security services and waste management are the primary growth drivers in soft facility management services in Egypt.

Source: GRC analysis

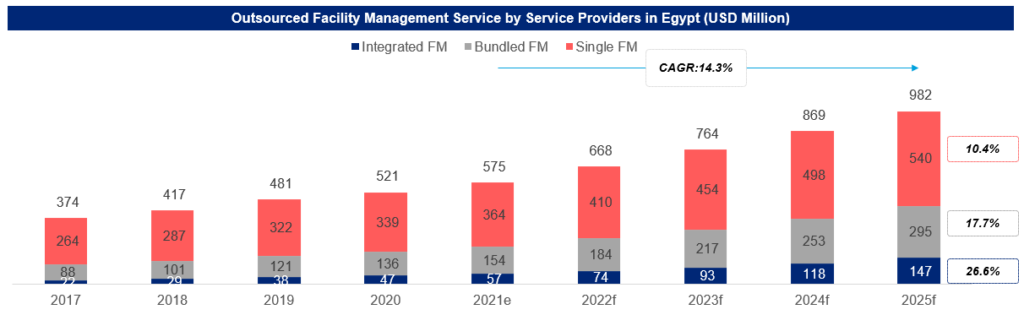

Integrated facility management service demand is expected to witness substantial growth during 2021-2025

Integrated facility management services are among the fastest growing facility management service in the country, mainly due to the demand for single point of contact for all type of services by real estate developers.

Few large facility management service providers are partnering with key real estate developers to form a JV o offer entire facility and community management service across all real estate projects in the country. For example, in 2021, Eltizam has partnered with Al Ahly Sabbour to launch two joint ventures (JVs) “Tafawuq Egypt” and “Three60 Egypt” with a combined value of USD130 million to provide Integrated Facilities Management (IFM) and Community Management (CM) services.

Bundled facility management is the second largest segment, mainly driven by the demand from end customers as well as part of subcontracting from integrated facility management providers.

Source: GRC analysis

Conclusion:

Total FM outsourcing market of Egypt was estimated to be about USD510 million in 2021, which is expected to grow at a CAGR of 9.0% during 2021-2025. Integrated facility management market is currently small – estimated to be about USD51 million in 2021, however, it is the fastest growing segment with projected growth of 27.6% between 2021 and 2025., and as such, Mega real estate projects and development of new administrative capital will trigger the opportunity for growth in the sector.