Facilities Management (FM) service is a critical function of real estate management. FM comprises the tools and services that support the functionality, safety, and sustainability of infrastructure real estate. FM services can be categorized into hard and soft FM, based on the type of services required. Hard FM deals with physical assets such as plumbing, wiring, elevators, and heating and cooling, while soft services refer to the FM services delivered to ensure secure, health and pleasant work environment and are directly related to employees of the company. FM services can be performed inhouse by real estate/property owners/management companies or can be outsourced to single or multiple vendors.

In Saudi Arabia, several integrated and bundled facility management service providers operate the FM market. These include:

- In-house providers

- Integrated FM providers

- Bundled FM providers

- Single FM providers

FM service market in KSA is expected to grow by 38% in the next 4 years

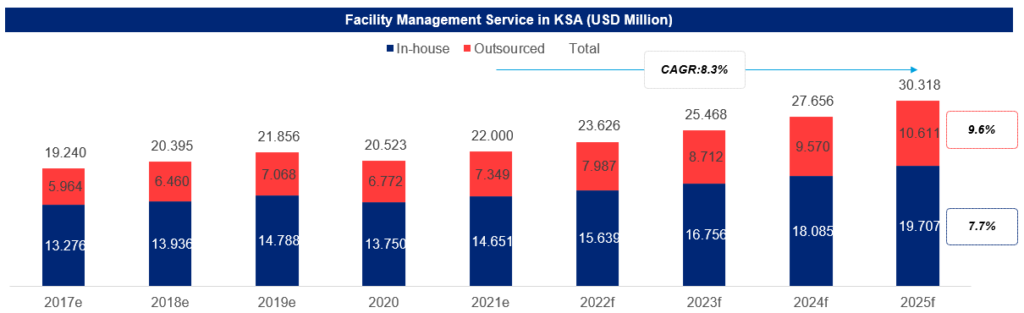

In 2021, FM service market in KSA was estimated to be about USD 23,626 million, contributing about 2.8% to the nominal GDP. The market is projected to grow at a CAGR of 8.3% during 2021-2025. In-house facility management practices accounted for about 67% of total market in 2021; however, the demand for outsourcing is increasing in the country, mainly driven by mega trends such as sustainability, and push from economic challenges post COVID.

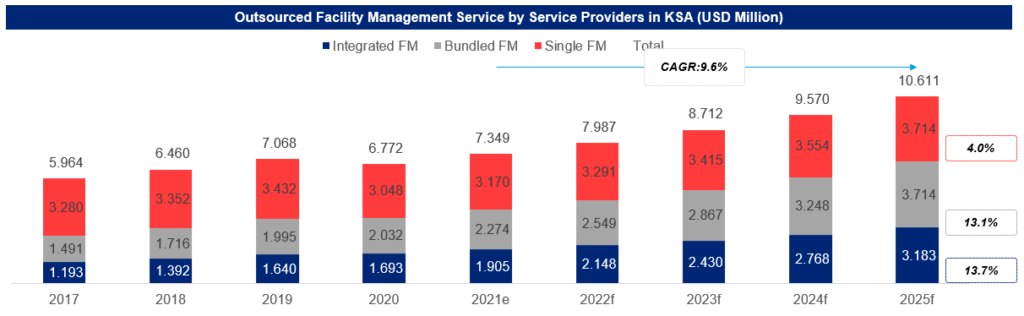

Demand for integrated facility management services accounted for 26% of total market in 2021 as illustrated in the chart below:

Source: GRC analysis

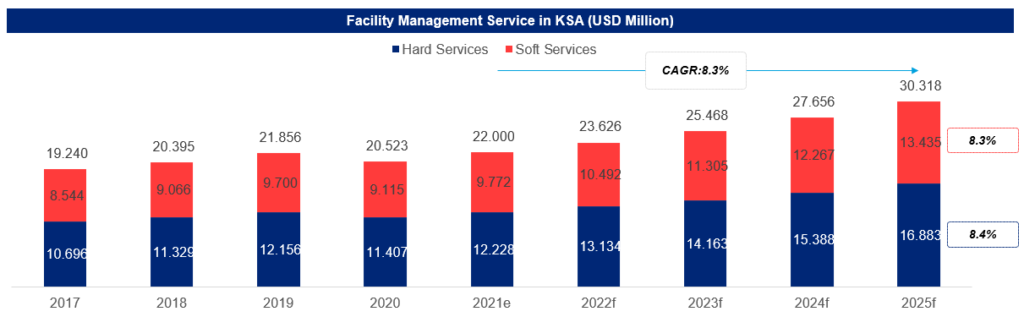

Hard FM services are expected to grow at a slightly faster rate than soft FM services in KSA

Between years 2021-2025 demand for hard services is expected to grow at a slightly higher rate of 8.4% as compared to soft services, which is expected to grow at a rate of 8.3%, As several ongoing mega construction projects such as Qiddiya, Neom etc. are expected to drive the demand for hard facilities management services in the country. Under hard services, demand of HVAC, lighting and fire is expected to grow at a faster rate than other hard services.

Rapid consolidation of facilities management market, which is supported by the establishment of several new international facilities management companies in Saudi Arabia, is expected to boost demand for soft services in the country.

Source: GRC analysis

FM market is currently dominated by single service providers; however, the demand for IFM is growing at a higher rate as illustrated below

Single FM service providers capture over 45% of total outsource market in 2021; mainly driven by demand in soft services such as pest control, security, waste management etc. Integrated facility management market was relatively smaller in 2021, accounted for about 25% of total market; however, the changing real estate scenario, such as increasing use of technology, sustainability focus and smart buildings are increasing the demand for integrated service provider which can manage all the property aspects and improve efficiency. Therefore, the integrated facility management market is expected to grow at a CAGR of 13.7% during 2021-2025.

Source: GRC analysis

Conclusion

From the above, we can see that the Facilities Management service market in Saudi Arabia is a highly fragmented market with presence of over 100 companies and low market concentration among leading companies. With integrated FM accounted for 26% of total outsourced market in 2021, of which is expected to reach 30% by 2025, growing at a rate of 13.7%, Bundled FM services are the second fastest growing segment with projected growth rate of 13.1%. In summary, eeconomic diversification, maturing real estate sector and Saudi Vision 2030 will drive the growth of this sector going forward. Opportunities galore for new market entrants.